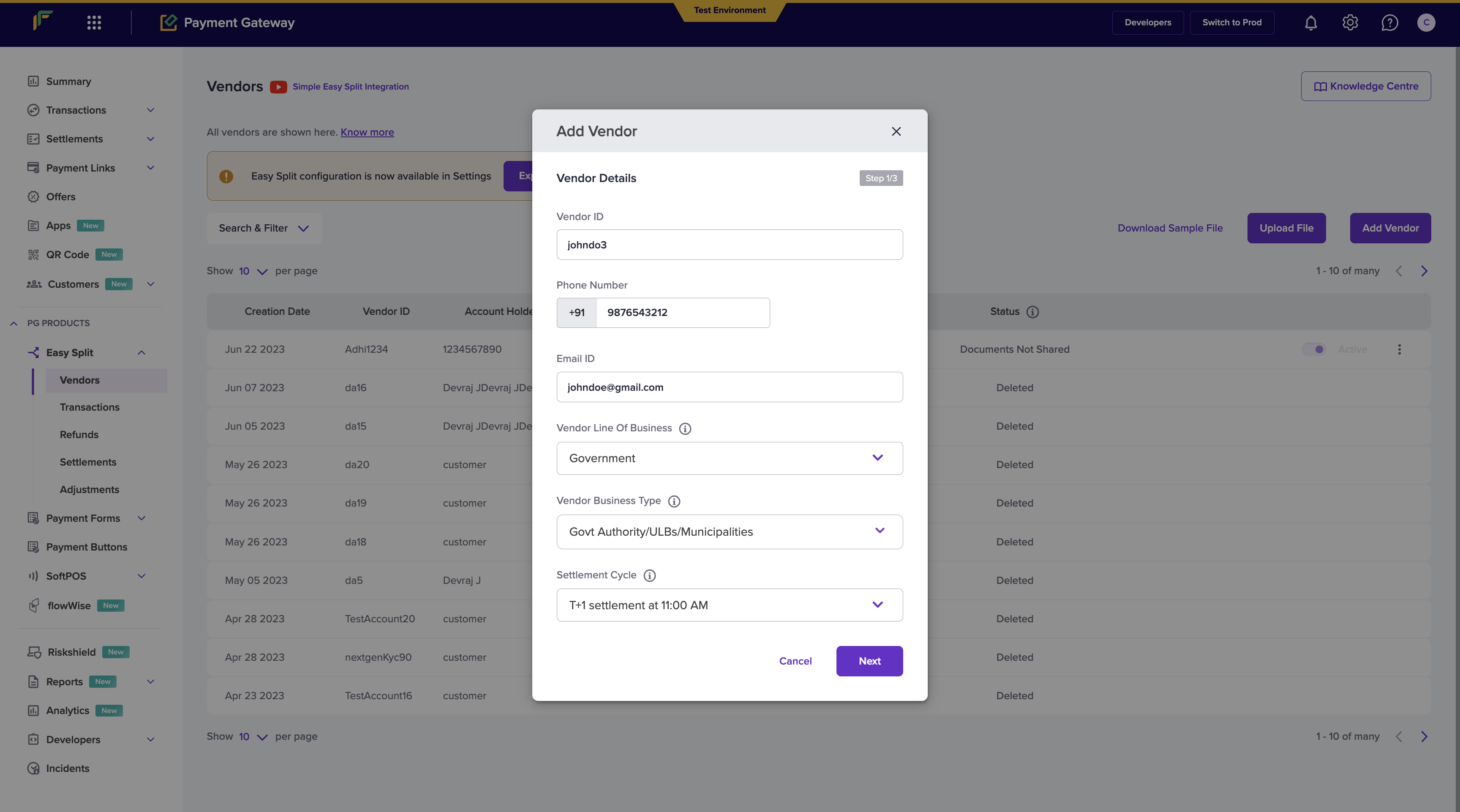

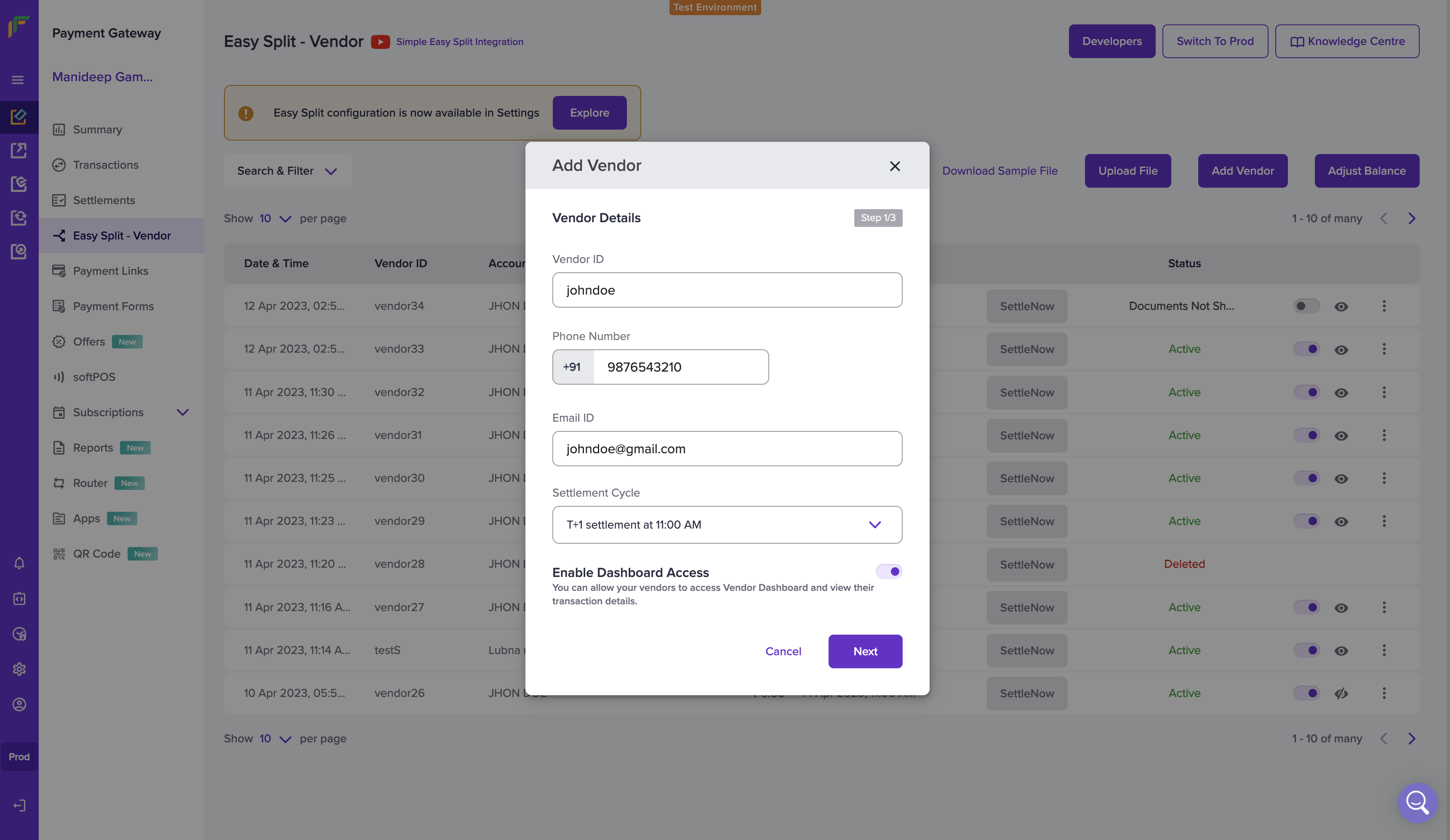

- Go to Payment Gateway Dashboard > Easy Split - Vendor > Add Vendor.

-

Enter the following details -

- Vendor ID - ID of the vendor.

- Phone Number - phone number of your vendor.

- Email ID - Email address of your vendor.

- Vendor Line of Business - Select your vendor’s line of business. Click here to know more.

- Vendor Business Type - Select the business type of your vendor. Click here to know more.

- Settlement Cycle - Select the schedule option through which you want to settle your vendors. Click here to know the available settlement cycles.

Once done, click Next.

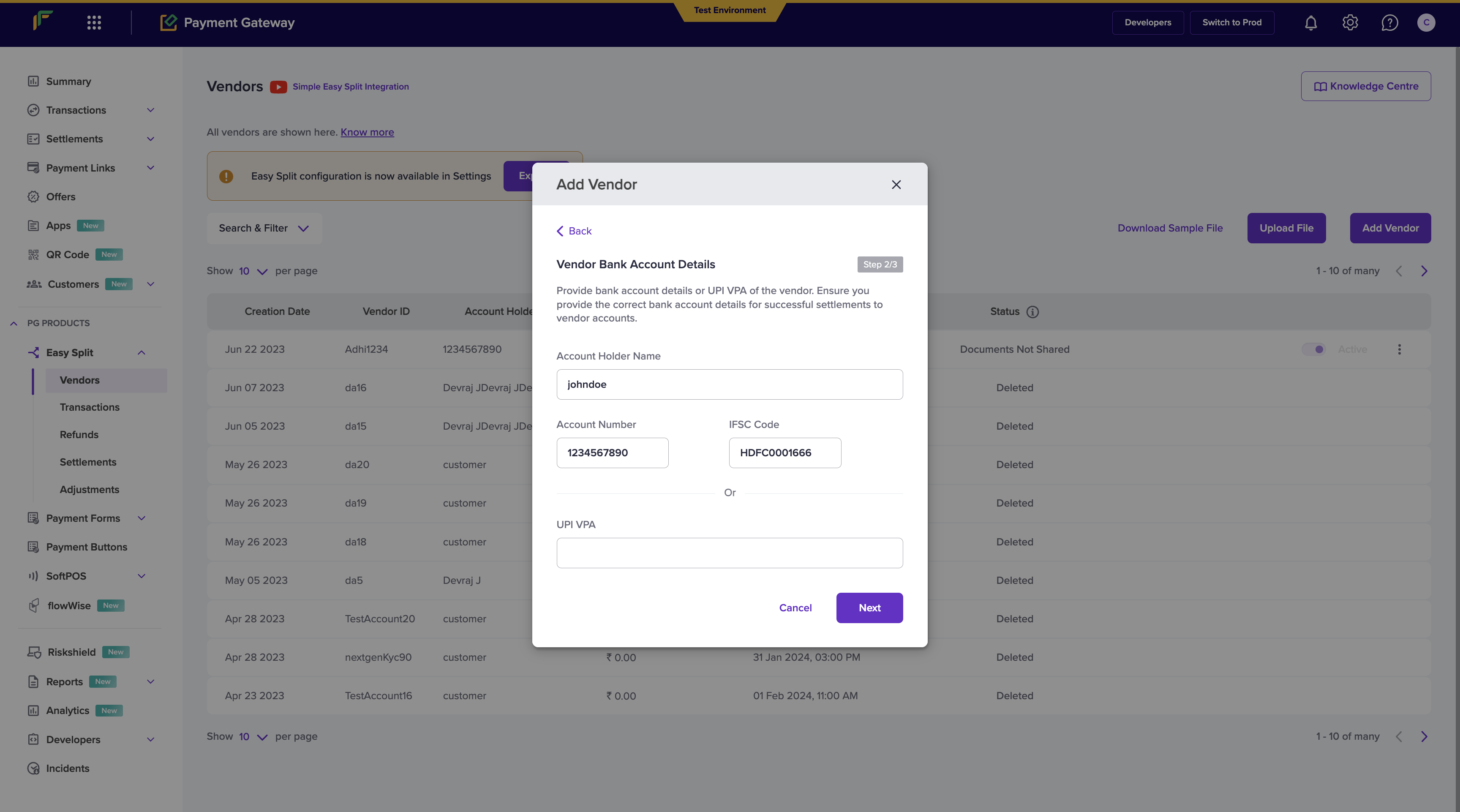

- Mention the Vendor Bank Account Details such as Account Holder Name, Account Number, and IFSC Code or UPI VPA to process payments to the vendor account.

Available Schedule Options

Use schedule option 8, 9, 14 or 17 to schedule instant settlements to your

vendor account.

| ID | Description |

|---|---|

| 1 | T+1* settlement at 11:00 AM. |

| 2 | T+2* settlement at 11:00 AM. |

| 3 | All transactions from 4:45 PM T-1 to 10:45 AM T+0* settled at 11:15AM T+0*, and, 10:45 AM T+0* to 4:45PM T+0* at 5:15PM T+0*. |

| 4 | All transactions from 2:00 PM T-1 to 2:00 PM T+0 settled at 3:00 PM T+0*. |

| 5 | All transactions till 5.30 PM at 6:00 PM. |

| 6 | Instant settlement every hour between 7:00 AM and 5:00 PM on working days. |

| 7 | Instant settlement every 3 hours between 8:00 AM and 5:00 PM on working days. |

| 8 | Instant settlement every hour 24*7. |

| 9 | Instant settlement every 3 hours 24*7. |

| 11 | Weekly every 1st working day. |

| 12 | Monthly every 1st working day. |

| 13 | T+1* settlement at 09:00 AM. |

| 14 | Instant settlement every 15 minutes 24*7. |

| 15 | T+3* settlement at 11:00 AM. |

| 16 | T+7* settlement at 11:00 AM. |

| 17 | Instant Settlement Every minute 24*7. |

- Select the Enable Dashboard Access option to allow your vendors to access the Vendor Dashboard. Click here to read more on Vendor Dashboard.

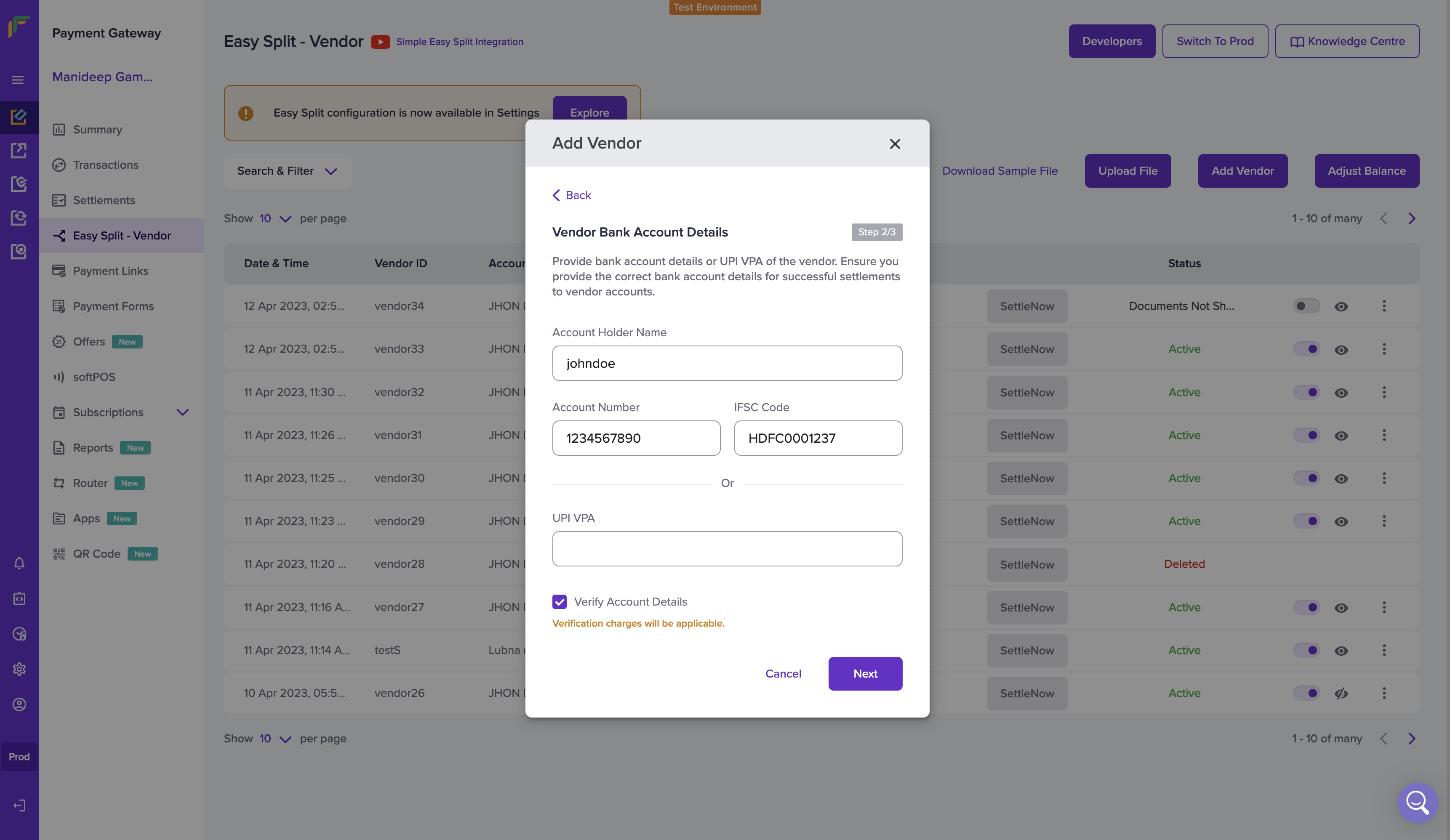

- Enter the vendor’s bank details like Account Holder Name, Account Number, IFSC Code or UPI VPA to process payments to the vendor account.

You can provide either the vendor bank or UPI details, both cannot be passed.

- Select the option Verify Account Details to verify the beneficiary bank account details or the UPI VPA. This ensures that the correct details are available and will help make successful settlements for the vendor.

You will be charged to verify bank accounts and to verify UPI VPA details.

Make sure you have sufficient balance, or proceed without account

verification.

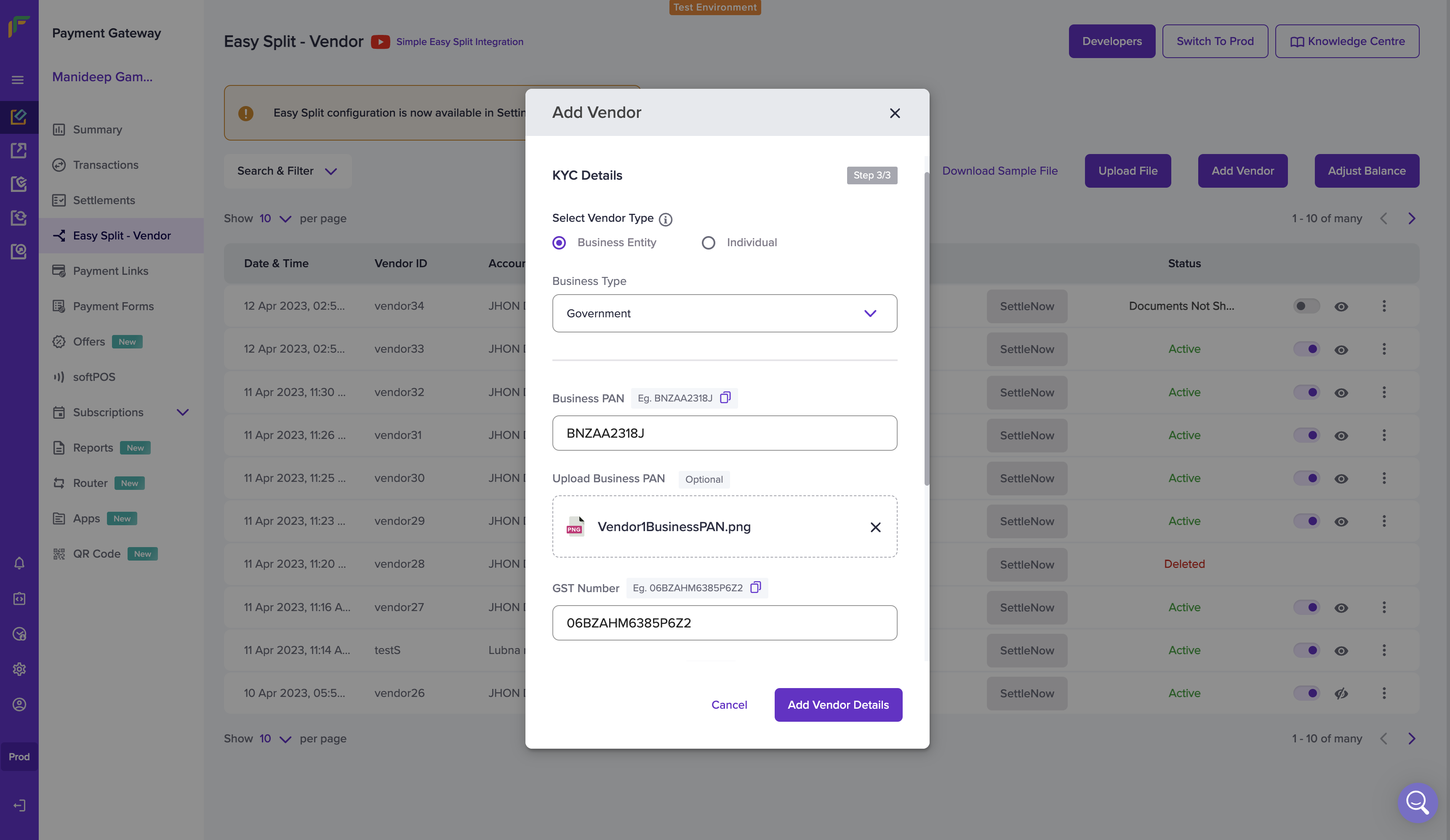

- Provide the vendor KYC details. Select the vendor type - Business or Individual. Select Individual type if your vendor’s annual turnover is 20 lakhs or lesser. Select Business Entity if your vendor’s annual turnover is more than 20 lakhs.

- Select the Business Type from the drop-down list. Provide your vendor’s Business PAN and upload the same. You will be required to provide other details of your vendors based on the vendor type.

- PAN

- Address Proof (Aadhaar, Driving License, Voter ID, Passport)

- Aadhaar Number

- NBFC Certificate

- Business PAN

- GST Number

- GST Certificate

- CIN Number

- CIN Certificate

- NBFC Certificate

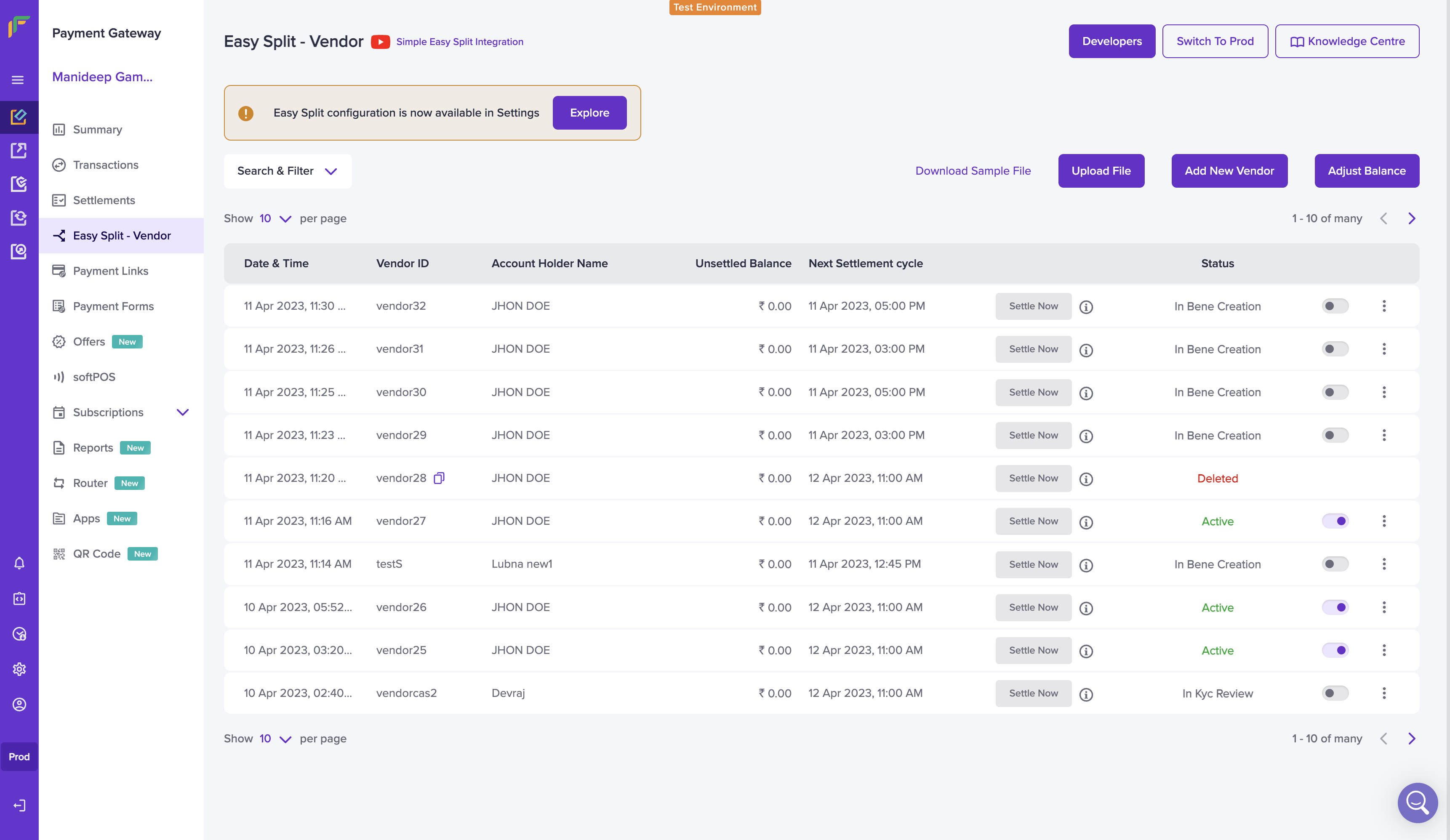

- Once done, click on Add Vendor Details. The vendor is added successfully. Vendor details are saved and can be used to process payments. The vendor details will be shown in the Easy Split - Vendor screen.

Vendor Status

Once you have added a vendor, it will go through various stages. They are mentioned in the table below.| Vendor Status | Description |

|---|---|

| IN_BANK_VALIDATION | This state indicates that the bank account validation process have been initiated. |

| BANK_VALIDATION_FAILED | This state indicates that the bank validation has failed. Update bank account details to correct one. |

| IN_BENE_CREATION | This state indicates that you have initiated the vendor creation process. |

| BENE_CREATION_FAILED | This state indicates that the beneficiary creation at the partner bank has failed. Update bank account details to retry new beneficiary creation. |

| IN_KYC_REVIEW | This state indicates that the vendor is created and not all the mandatory KYC documents are successfully verified. Ensure all mandatory documents are submitted. |

| ACTION_REQUIRED | This state indicates that either one or multiple KYC documents has failed verification. Merchant should provide - correct/updated/relevant KYC documents to progress further with vendor onboarding. |

| ACTIVE | This state indicates that the vendor KYC documents are verified successfully and your vendor is Active. |

| ON_HOLD | The On-hold status is updated by the Cashfree Payments team. The onboarding team has put the account On-hold because either the document is not available or the documents shared are insufficient. |

| BLOCKED | This state indicates that the vendor is blocked. |

| DELETED | This state indicates that the vendor is deleted. |

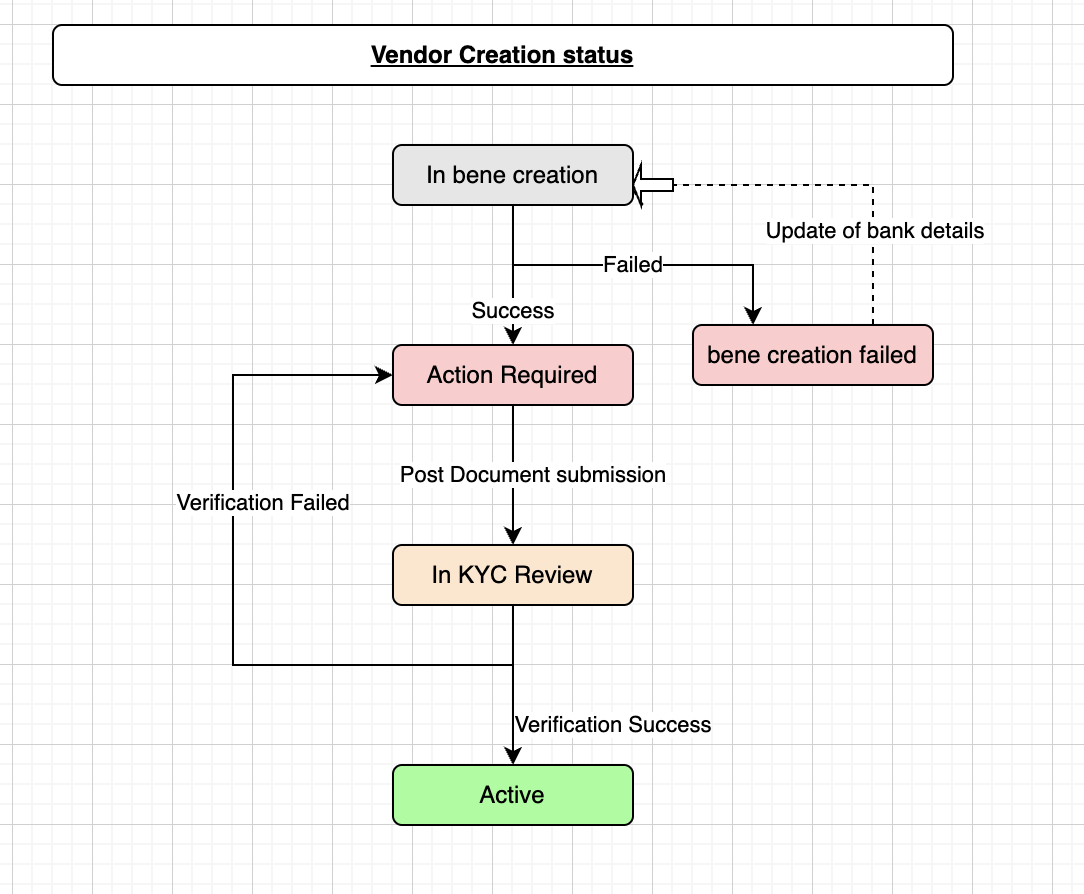

Vendor Status Workflow

When you onboard a vendor from the dashboard or use our APIs, they go through various states. They are explained in the section below. The various vendor status during the onboarding process is mentioned in the table below.| Vendor Status | Description |

|---|---|

| IN_BANK_VALIDATION | This state indicates that the bank account validation process have been initiated. |

| BANK_VALIDATION_FAILED | This state indicates that the bank validation has failed. Update bank account details to correct one. |

| IN_BENE_CREATION | This state indicates that you have initiated the vendor creation process. |

| BENE_CREATION_FAILED | This state indicates that the beneficiary creation at the partner bank has failed. Update bank account details to retry new beneficiary creation. |

| IN_KYC_REVIEW | This state indicates that the vendor is created and not all the mandatory KYC documents are successfully verified. Ensure all mandatory documents are submitted. |

| ACTION_REQUIRED | This state indicates that either one or multiple KYC documents has failed verification. Merchant should provide - correct/updated/relevant KYC documents to progress further with vendor onboarding. |

| ACTIVE | This state indicates that the vendor KYC documents are verified successfully and your vendor is Active. |

| ON_HOLD | The On-hold status is updated by the Cashfree Payments team. The onboarding team has put the account On-hold because either the document is not available or the documents shared are insufficient. |

| BLOCKED | This state indicates that the vendor is blocked. |

| DELETED | This state indicates that the vendor is deleted. |

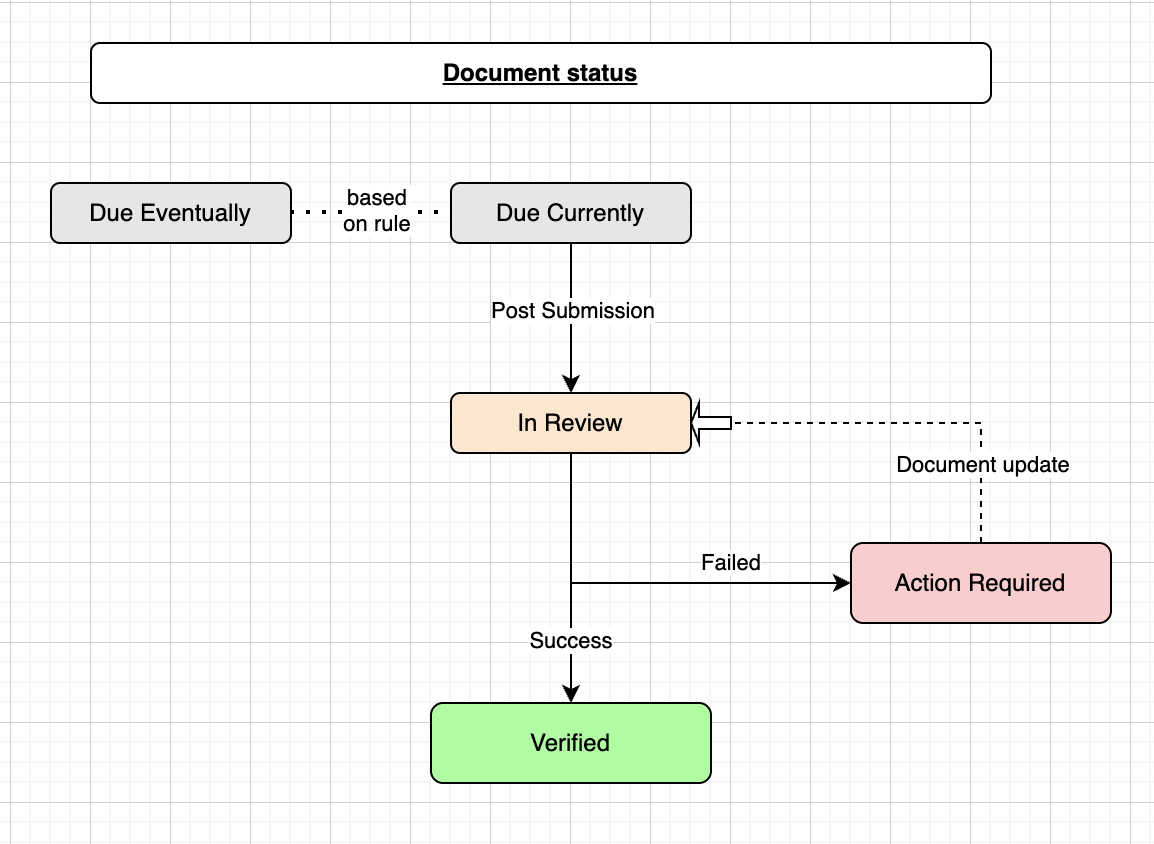

Document Status Workflow

The various states a document goes through during the verification process is mentioned in the table below:| Document Status | Description |

|---|---|

| Due Currently | All the documents in this state are pending mandatory documents. These documents are to be submitted to onboard a vendor. |

| Due Eventually | These are additional documents that needs to be submitted basis different limits. If a vendor is going to breach certain limits in future, it is recommended to share these documents along with other documents in “Due currently” category. This will ensure that the vendor state will not be impacted due to limit breaches. Example: GST will be mandatory if sum of vendor settlement to single PAN/merchant across vendors will exceed 20 lakhs in last twelve months |

| In Review | This state indicates that the KYC documents are submitted and under review. Once the verification process is completed, the documents status will change to “Verified” or “Action Required”. |

| Verified | This state indicates that the KYC document submitted is verified successfully. |

| Action Required | This state indicates that the KYC document verification has failed and you are required to take corrective action (upload correct or fresh document). |

KYC Document Requirement

Before you begin adding vendors, you must know the documents that are required based on the merchant type and vendor type. Please find below the required document basis limit.| Document Requirement | Limit | Alternatives |

|---|---|---|

| PAN | Required for all limit | GSTIN |

| GSTIN | > 20 Lakhs | NA |

List of Vendor Line of Business (LOB)

Vendor LOB

Vendor LOB

| Vendor LOB |

|---|

| B2B |

| Digital Goods |

| E-commerce |

| Education |

| Financial Services |

| Food and Beverages |

| Gaming |

| Government |

| Grocery |

| Health care |

| Insurance |

| Jewellery |

| NBFCs/Organizations into Lending |

| Logistics |

| Miscellaneous |

| Mutual funds/Broking |

| Non Profit/NGO |

| Online Gaming |

| Open and Semi Open Wallet |

| Pan shop |

| Pharmacy |

| Readymade |

| Real Estate, Housing, Rentals |

| Retail and Shopping |

| SaaS |

| Social Media and Entertainment |

| Society/Trust/Club/Association |

| Telecom |

| Travel and Hospitality |

| Utilities |

| Chit Funds |

| Web host/Domain seller |

| Professional Services (Doctors, Lawyers, Architects, CAs, and other Professionals) |

Vendor LOB Specific Documents

NBFC

NBFC

If vendor type is NBFC, then there are additional documents required:

- CIN

- NBFC and LSP Agreement

- NBFC Certificate

- NBFC domain confirmation email on Cashfree partnership

Adding Multiple Vendors

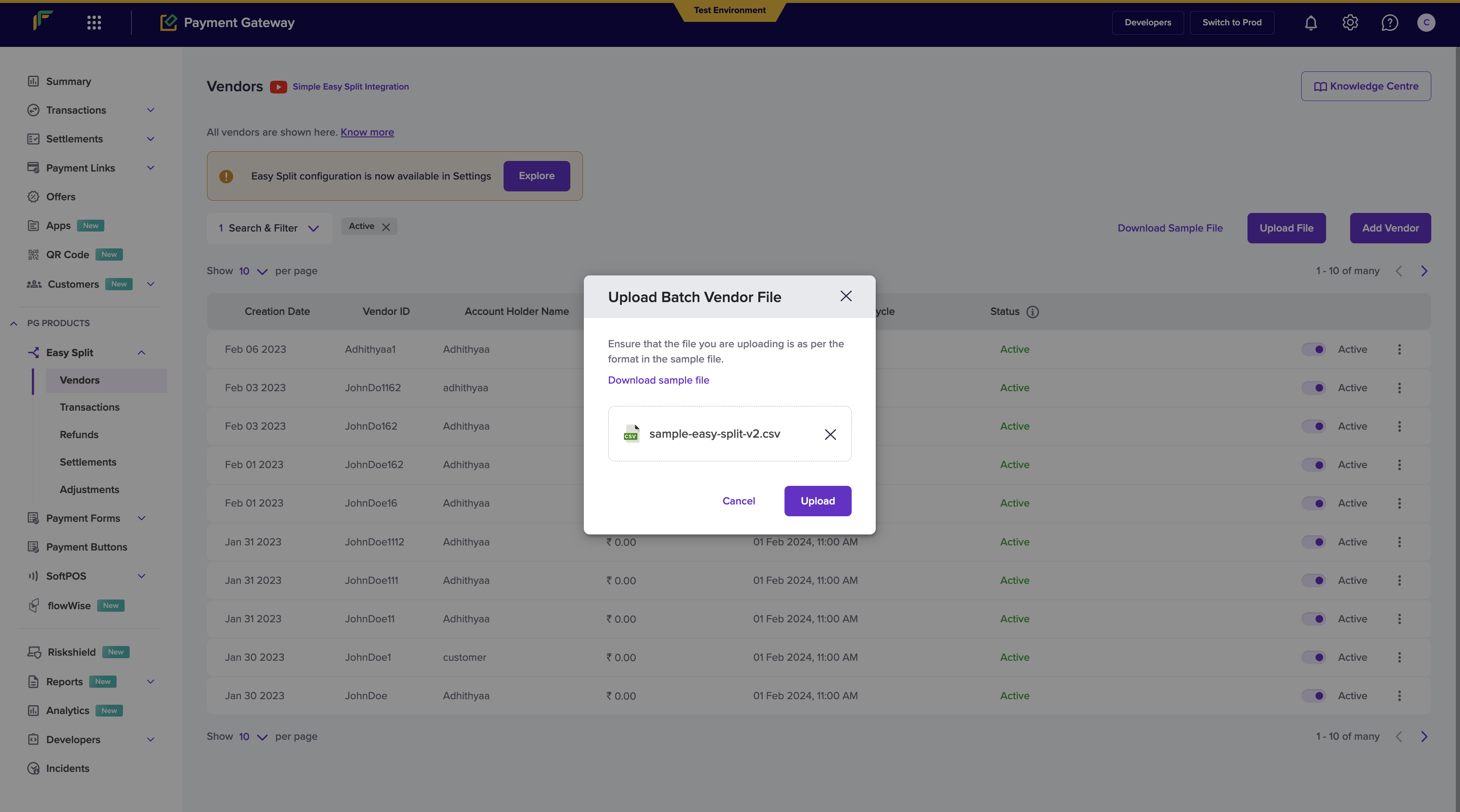

Use the Batch Upload feature to add a large number of vendors at a time. Add all the required details in a single file as per the required format and upload the file. Download the sample file to know what details are required to be filled in the batch file. To upload a batch file,- Go to Payment Gateway Dashboard > EasySplit - Vendor > click Upload File.

- Click Choose a file to select the file you want to upload and then click Upload. After successful processing, all vendor details will be added, and you can start processing payments to these vendors.

- The maximum file size allowed is 8 MB, and a maximum of 50 records can be included in the file. - The file cannot be uploaded if it is not as per the suggested format. Also, if there are any errors in the uploaded file, you must resolve all the errors and upload the file again.