How pre-authorization works?

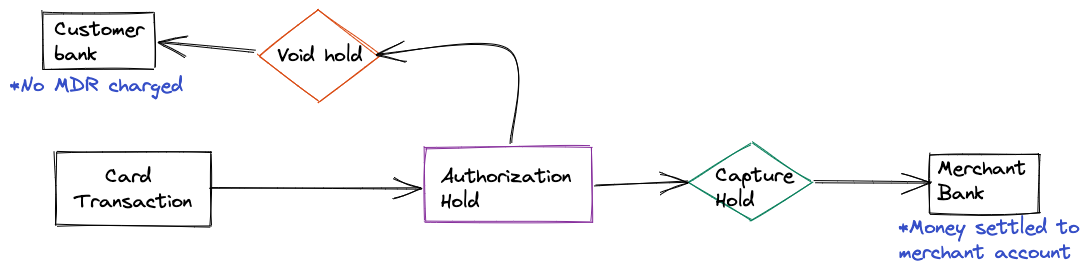

With pre-auth, you can :- Authorize an amount on a customer’s card without immediate capture.

- Capture the authorized amount later (fully or partially) when ready.

- Void the authorization to release funds if the transaction is not completed.

Pre-authorization flow

- The customer initiates the payment.

- The amount is blocked on the customer’s card after successful payment completion.

- The merchant can:

- Either Capture the full or partial amount. OR

- Void the authorization to release the blocked funds to the customer.

Note: If not captured within seven days, the funds are automatically released.

Pre-authorization feature request

- To enable pre-auth for your account, submit a request via the Support Form.

Managing pre-authorization transactions

You can capture or void pre-auth transactions from the Cashfree Merchant Dashboard or integrate the capture and void APIs to automate the process.Note

- You must capture or void a pre-auth transaction within seven days of authorization.

- A transaction can only be captured or voided once.

- Once captured, a transaction cannot be voided.

- Once voided, a transaction cannot be captured.

- Transactions not captured within 7 days are automatically released back to the customer.

- Voided transactions return funds to the customer immediately.

- After pre-auth is enabled for your account, ensure all Pre Auth transactions are either captured or voided.

Supported payment instruments for pre-authorization

Cashfree Payment Gateway supports pre-auth workflow on cards and UPI (Unified Payments Interface).Cards

If you are using cards, you do not need to provide any additional parameters while initiating the payment. Below is a sample/orders/pay request and response:

UPI

For UPI pre-auth, you need to pass additional parameters in the/orders/pay API request. Once you have created the order, invoke the Order Pay API call with the authorize_only, authorization parameters.

The authorization object contains the following attributes:

approve_by- The time by when customer needs to approve this one time mandate request.start_time- The time when the mandate should start.end_time- The time until when the mandate hold will be on customer’s bank account. You can call capture and void until this time.

UPI Collect

Below is a sample UPI Collect request and response:UPI Intent

Below is a sample UPI Intent request and response:Capture

The capture workflow helps you to capture the payment and move the authorised amount partially or completely from customers bank account to your bank account.Void

The void workflow helps you to release the entire authorized amount back to the customer.FAQs

What is a capture call in Pre-Authorization?

What is a capture call in Pre-Authorization?

What is the validity of capture?

What is the validity of capture?

If not captured within 7 days, the authorization expires, and the funds are released back to the customer.

Can a merchant capture a partial amount?

Can a merchant capture a partial amount?

Yes, merchants can capture a partial amount of the authorized funds.

Is MDR charged on the authorized or captured amount?

Is MDR charged on the authorized or captured amount?

Which cards support pre-authorization?

Which cards support pre-authorization?

What is void in Pre-Authorization?

What is void in Pre-Authorization?

Can a merchant void a partial amount?

Can a merchant void a partial amount?

No, voiding must be for the entire authorized amount.

What are some common use cases for Pre-Authorization?

What are some common use cases for Pre-Authorization?

Is pre-authorization feasible via payment links and payment forms?

Is pre-authorization feasible via payment links and payment forms?

How does settlement occur in a pre-authorization transaction?

How does settlement occur in a pre-authorization transaction?

When does the merchant receive the funds in a pre-authorization transaction?

When does the merchant receive the funds in a pre-authorization transaction?

What happens if a customer disputes a settled transaction?

What happens if a customer disputes a settled transaction?

A dispute may result in a chargeback, requiring the merchant to provide proof of authorization and service fulfillment.

Is the pre-authorization feature supported on American Express and Diners cards?

Is the pre-authorization feature supported on American Express and Diners cards?