Commissions

How does it work?

For Payment Gateway collections: your commission reflects on your partner dashboard when a customer makes a transaction on your referred merchant’s website/app and the amount is settled to Cashfree Payments.Calculate Commissions

Commissions are calculated in two ways:- Flat rate

- Percentage of the transaction amount

Flat rate pricing involves charging a fixed rate for a transaction. It does not alter or fluctuate regardless of the transaction amount. For example, let us say you are an e-commerce automation platform, and you help e-commerce businesses in converting COD orders to pre-paid. You have offered Cashfree’s Payment Gateway to one of your clients, ABC Ltd., at a markup of ₹100 over Cashfree’s base rate of 3% (the minimum amount that goes to Cashfree Payments). Here is the calculation for the transaction that ABC Ltd. collected ₹10,000 using Cashfree Payments.

| Transaction Amount (A) | Cashfree’s Charge (Base rate) (B) | Your Markup (C) | GST (D) | Total Amount Paid by your Client |

|---|---|---|---|---|

| ₹10,000 | 3% (10,000*3%) = ₹300 | ₹100 | (300+100)*18% = ₹72 | B+C+D = ₹472 |

Percentage pricing involves charging a specific percentage for a transaction. For example, let us say you have offered Cashfree’s payment gateway to ABC Ltd. at a markup of 1% instead of INR 100 over Cashfree’s base rate of 3% (the minimum amount that goes to Cashfree Payments).

| Transaction Amount (A) | Cashfree’s Charge (Base rate) (B) | Your Markup (C) | GST (D) | Total Amount Paid by your Client |

|---|---|---|---|---|

| ₹10,000 | 3% (10,000*3%) = ₹300 | 1% (10,000*1%) = ₹100 | (300+100)*18% = ₹72 | B+C+D = ₹472 |

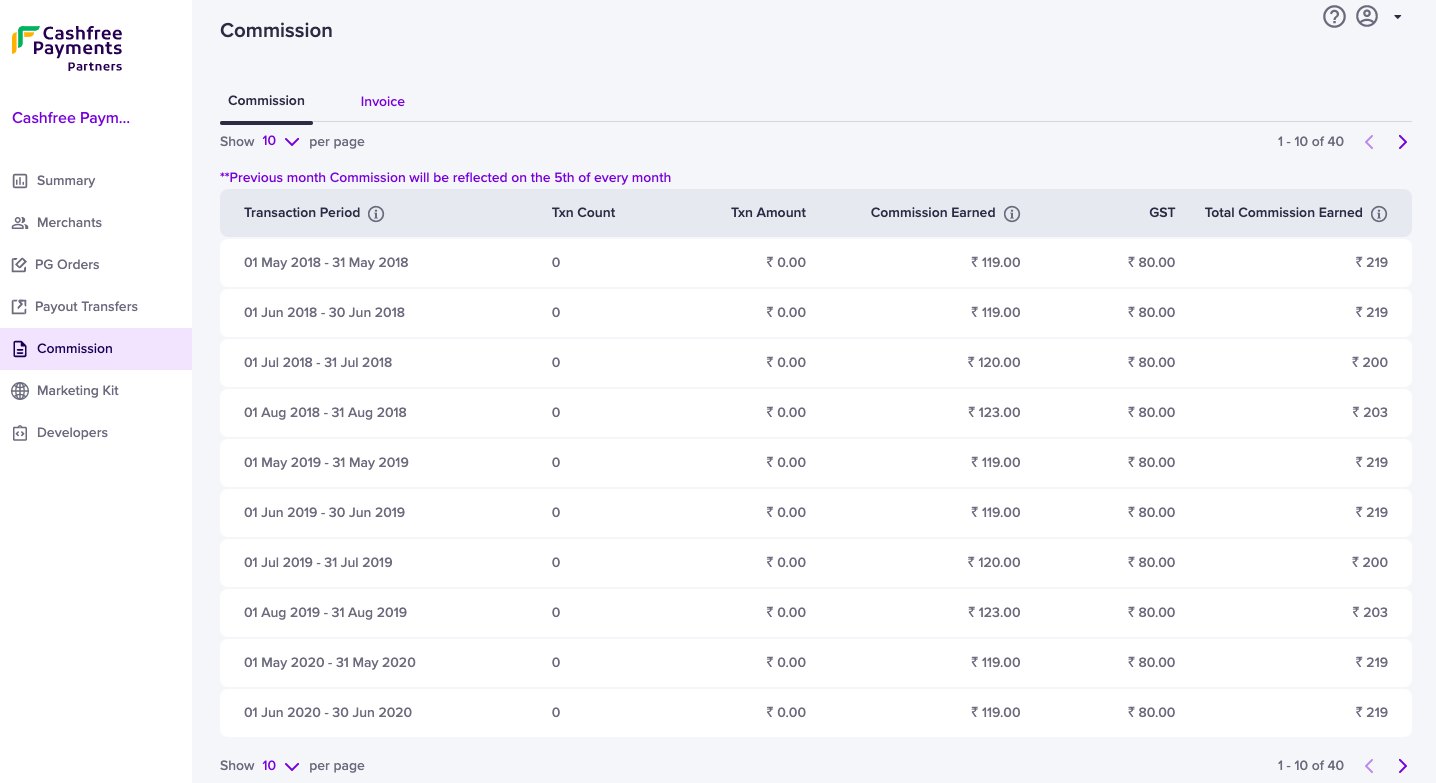

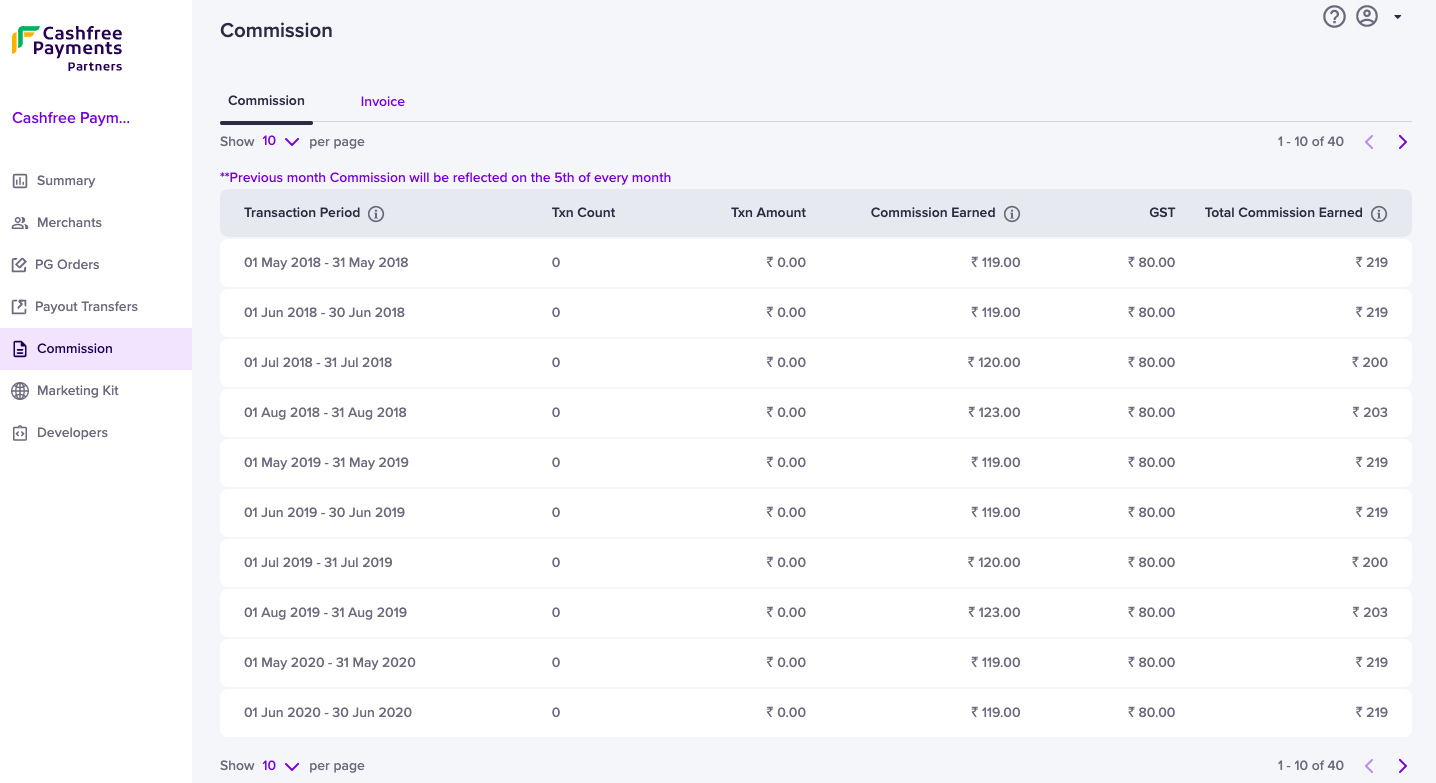

View Commissions

You can track all your commissions from the embedded payments dashboard.- Login to your dashboard using your credentials. Select Commission to view the total commission earned on transactions for a particular period.

- To track payment gateway transactions by your merchants, select PG Orders in the navigation section on the left. You can view the number of transactions, total transaction amount, and commission earned by you on those transactions for every merchant.

Commission for GST Registered and Unregistered Partners

If you are GST registered and shared the GSTIN details with Cashfree Payments, you will see the GST component in the Commission section. This information is not visible to the unregistered partnerss. All GST-registered partners must share their GSTIN with Cashfree Payments as per compliance requirements. Fill out the Support Form to update your GST details.

Receive Commission Amount

To initiate your commission settlement process for the previous month, you must create an invoice. Click here for more information on how to create an invoice.To claim your commission, ensure Partner KYC is complete, and the commission

structure is configured on your Cashfree Payments Partner account. If the

commission structure is not configured on your Partner account, write to

partnership.support@cashfree.com.

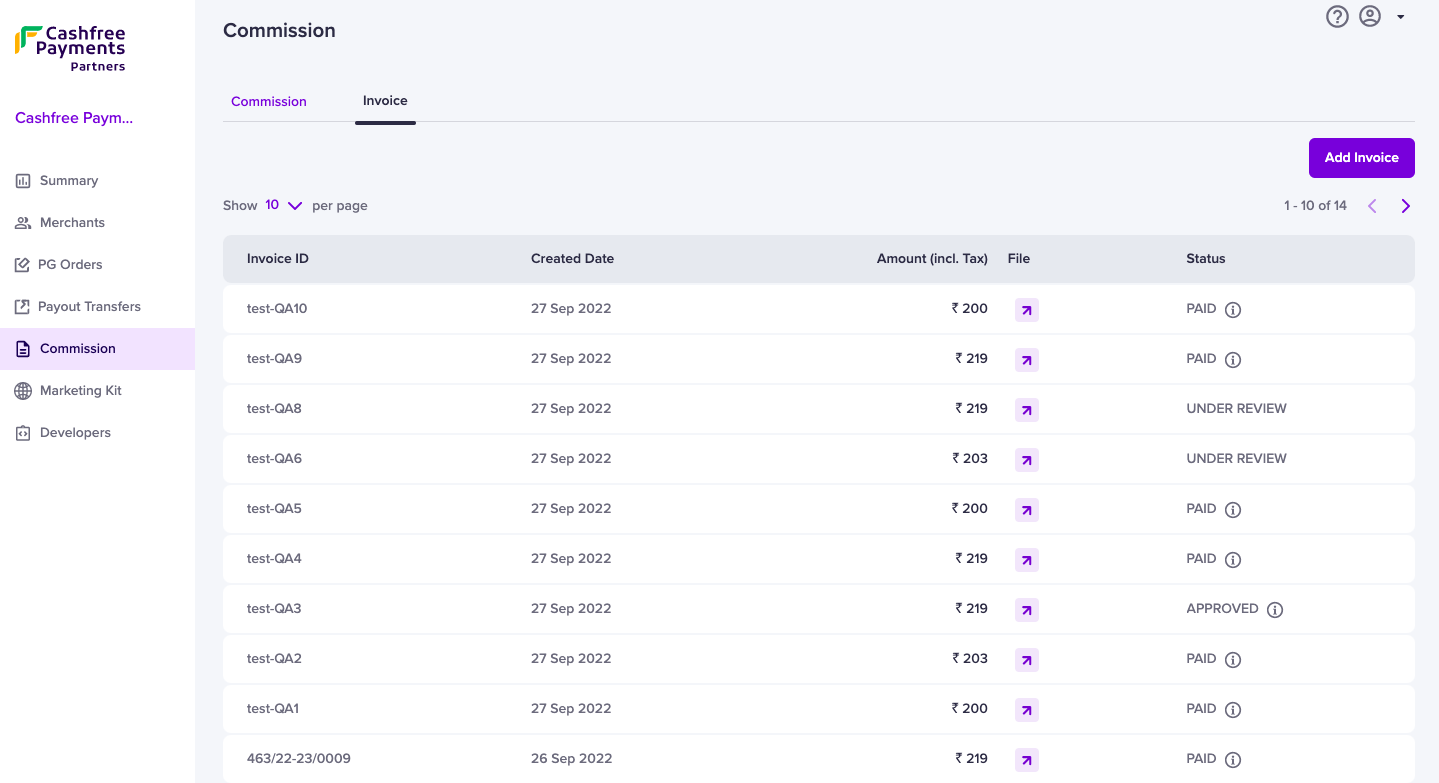

Invoices

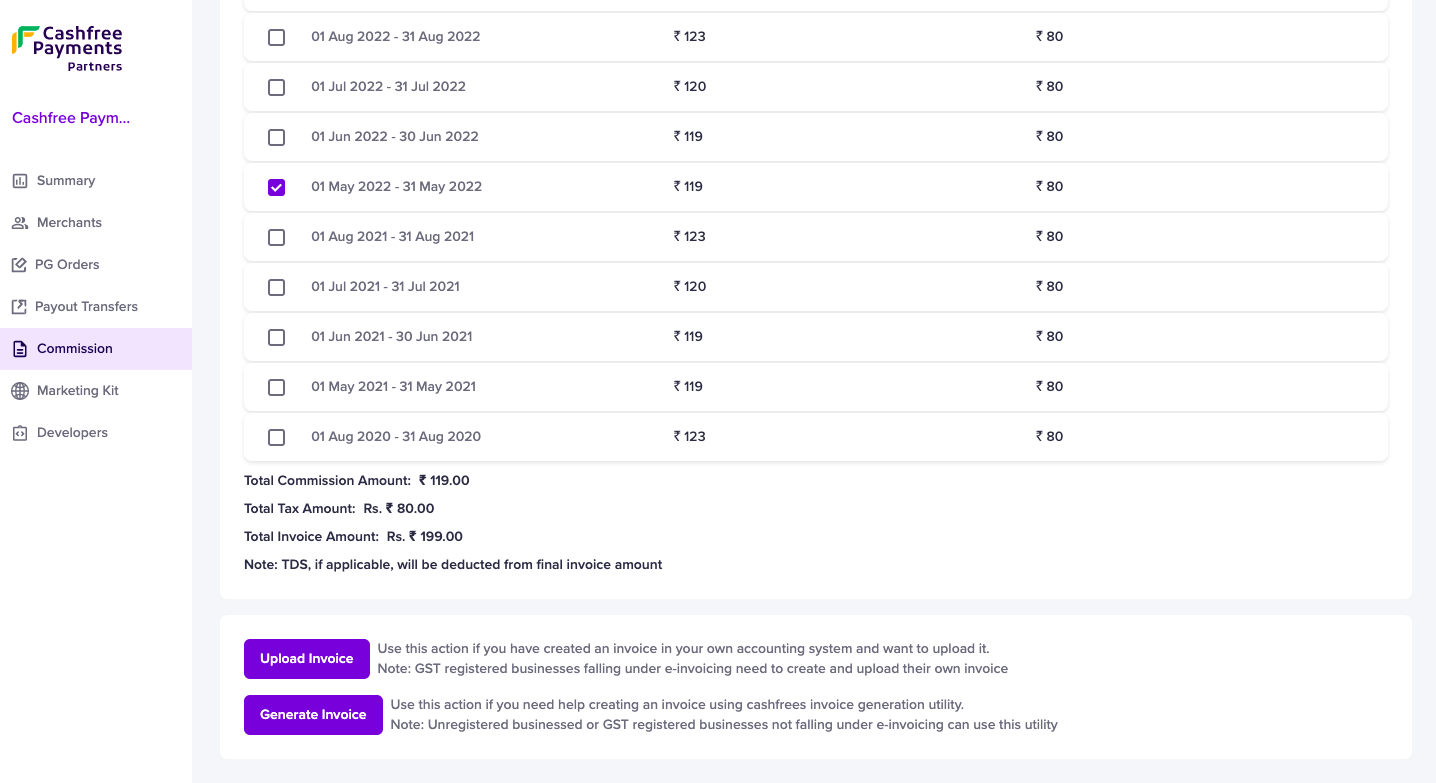

To receive the commission amount for the previous months: you must create an invoice, specify the mandatory details, and upload the invoice. To raise an invoice,- Login to the partner dashboard using your credentials. Select Commission > Invoice.

- Click Add Invoice.

- Select the months for which you want to create an invoice.

- If you use an accounting system and want to upload an invoice using the same system, you can click Upload Invoice. Ensure your company’s GSTIN and Cashfree Payments GSTIN are specified in the invoice.

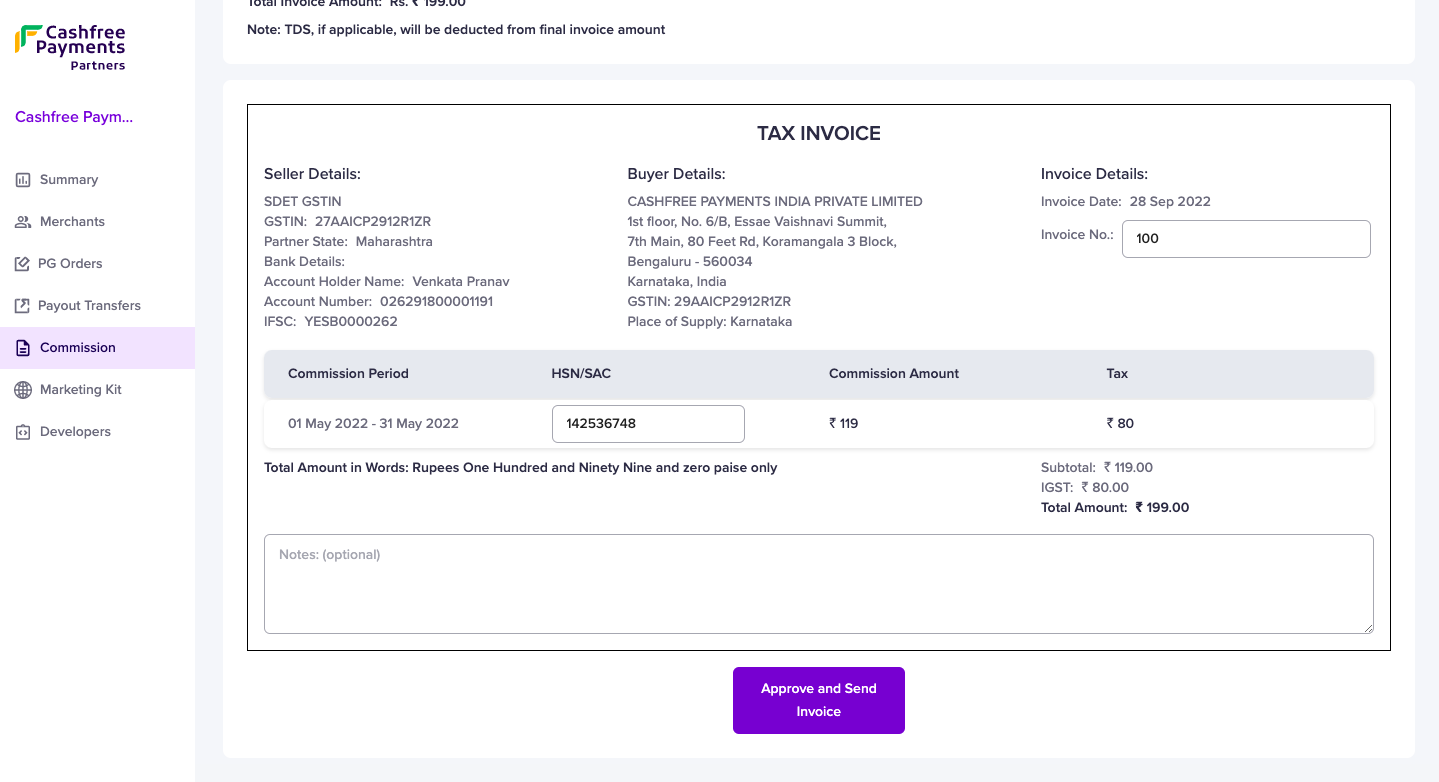

Alternatively, you can click Generate Invoice if you need help with creating the invoice. Cashfree Payments automatically creates an invoice. You can enter the mandatory details and send the invoice.

- Upload or generate the invoice and enter the mandatory details. Click Approve and Send Invoice to send the invoice to Cashfree Payments for further processing of the commission amount.

Invoice Statuses

| Status | Description |

|---|---|

| Under Review | The invoice status is yet to be verified by Cashfree Payments. |

| Approved | The invoice is verified and approved for processing the commission amount. |

| Payout in Progress | The commission amount is initiated for payout by Cashfree Payments. |

| Paid | The commission amount is settled in your bank account registered with Cashfree Payments. |

| Rejected | The invoice is rejected by Cashfree Payments. |